Business Valuation - why and when?

In today's highly competitive market landscape, determining the true value of a business is a complex task, influenced by various dynamic factors within an ever-changing environment. Although SaaS companies demonstrated strong resilience, they were not immune to the wider economic impact.

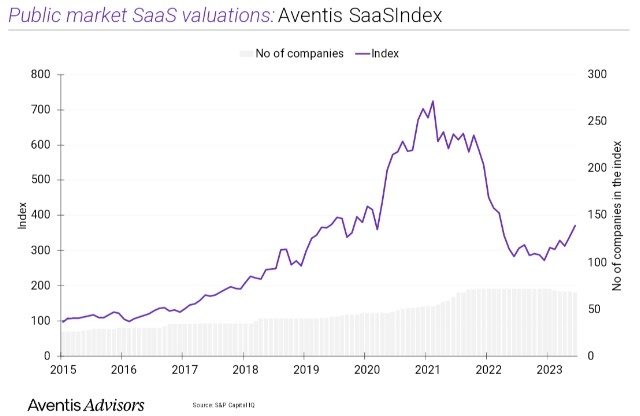

It’s been a bumpy ride for most SaaS companies in the last 24 months. After peaking in 2021 the valuations of public SaaS companies have gone down dramatically. The Aventis SaaS index graph below shows a good illustration of the impact (60% down) mostly influenced by a materially higher cost of capital given the rising interest rate environment. By the end of H1 2023, the index has however rebounded, fuelled by the market rally and the hopes of AI revolution. At the same time, the rebound was largely driven by established large-cap companies, while many smaller companies remained fairly stagnant.

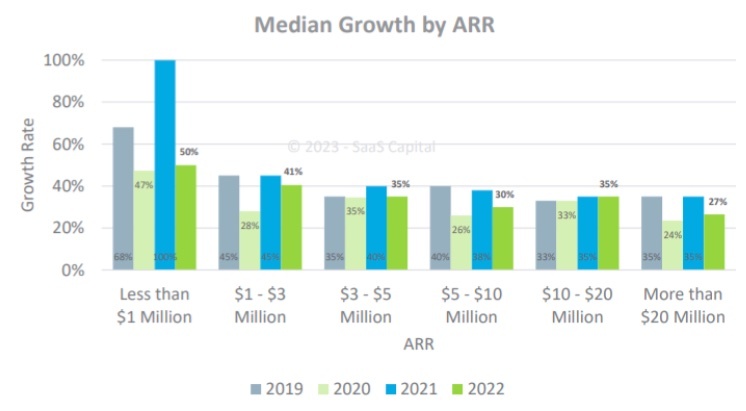

One of the key underlying drivers of business valuation is a growth rate, which has also demonstrated somewhat depressed dynamics lately. According to SaaS Capital's research on B2B SaaS companies' growth in 2023, the overall median growth rate for all surveyed companies was 35%. This figure, while impressive, is lower than that of 2021 and closely aligns with the growth levels seen during the pandemic in 2020.

Source: https://www.saas-capital.com/research/

Whilst facing so many moving parts makes it complex to understand your business's worth, it’s not insurmountable and can help your business to navigate current uncertainty. Let's delve deeper into the concept of business valuation and explore how it can significantly benefit your business.

Whilst facing so many moving parts makes it complex to understand your business's worth, it’s not insurmountable and can help your business to navigate current uncertainty. Let's delve deeper into the concept of business valuation and explore how it can significantly benefit your business.

What is Business Valuation, and When Do You Need It?

In essence, business valuation is the process of determining a business's monetary value based on prevailing market conditions. This assessment considers a business's assets, including property and inventory, as well as income and market dynamics. Insights gained from business valuations provide valuable information about growth potential, operational strengths, weaknesses, and overall sustainability within today's fiercely competitive business environment.

Here are seven compelling reasons why you should consider valuing your business:

Investment Opportunity: A business valuation is crucial when presenting your business to potential investors or seeking capital. It serves as a tangible indicator of stability or growth potential, offering social proof to potential backers.

Planning Succession: If you plan to transfer business ownership through share sales or succession, an accurate business valuation ensures a seamless transition process.

Selling the Business: When selling your business, knowing its true value is essential to receive appropriate compensation for your hard work and dedication.

Financing: For business growth, loans might be necessary, and refinancing could be considered. Banks and creditors require detailed information about your company's value to facilitate these processes.

Strategic Planning: Business valuation offers profound insights into your business's current state, aiding in strategic planning and identifying growth areas.

Dispute Resolution: In situations involving partnership disputes or legal complexities, an accurate business valuation serves as an objective reference point, facilitating fair resolutions.

Tax Purposes: Government agencies may require your business's valuation for ownership transfers. Selling below market value could trigger gift taxes. Additionally, estate tax returns or business bequeathment might necessitate valuation.

Here are seven compelling reasons why you should consider valuing your business:

Investment Opportunity: A business valuation is crucial when presenting your business to potential investors or seeking capital. It serves as a tangible indicator of stability or growth potential, offering social proof to potential backers.

Planning Succession: If you plan to transfer business ownership through share sales or succession, an accurate business valuation ensures a seamless transition process.

Selling the Business: When selling your business, knowing its true value is essential to receive appropriate compensation for your hard work and dedication.

Financing: For business growth, loans might be necessary, and refinancing could be considered. Banks and creditors require detailed information about your company's value to facilitate these processes.

Strategic Planning: Business valuation offers profound insights into your business's current state, aiding in strategic planning and identifying growth areas.

Dispute Resolution: In situations involving partnership disputes or legal complexities, an accurate business valuation serves as an objective reference point, facilitating fair resolutions.

Tax Purposes: Government agencies may require your business's valuation for ownership transfers. Selling below market value could trigger gift taxes. Additionally, estate tax returns or business bequeathment might necessitate valuation.

The business valuation process is not a one-time event. It involves a comprehensive assessment of factors in your industry, financial health, operational efficiency, market competition, and future growth prospects. Tangible assets like equipment and liabilities such as taxes are considered, and intangible assets like software, patents, and intellectual property play a crucial role.

Business owners often explore the value of their “child” by placing their business on platforms like Micro Acquire, not necessarily for selling, but to gain insights into new horizons and possibilities. Getting hard proof of someone actually making an offer to buy your business is a very powerful insight.

Benefits for the Future

A business valuation offers multiple benefits, enabling business owners to strike a balance between sustained success and potential stagnation:

Stay tuned for more insights on various valuation methods. Be sure to check out our business valuation tool for instant or precise valuations with key underlying metrics.

- Equips owners with robust insights into business health

- Facilitates informed decision-making and strategic planning

- Acts as an ongoing tool to keep up with market trends and fluctuations

Stay tuned for more insights on various valuation methods. Be sure to check out our business valuation tool for instant or precise valuations with key underlying metrics.